Fraud, Cyber, & Governance Conference: Creating a Fraud-Resistant Organization

EARN UP TO 8 CPE CREDITS

Organizations, on average, lose 5% of their annual revenues to fraud. This is according to the May 2022 Report to the Nations from the Association of Certified Fraud Examiners (ACFE) based on a global survey spanning 133 countries and 2000 organizations. While asset misappropriation schemes are the most common occurring in 86% of the cases with a median loss of $100,000, financial statement fraud occurs only 9% of the time, but is far more costly with a median loss of $593,000. Overall, annual estimates of fraud globally approach a whopping $4.7 trillion.

And don’t forget cyberattacks. According to Coalition’s 2022 Cyber Claims: Mid-year Update report, phishing has become one of the most common attack vectors. While Coveware, a ransomware incident response firm, reports that the average ransom payment in Q1, 2022 was $211,259 and the median ransom payment was $73,906. The frequency of cyber attacks compels organizations to move from cyber security strategies to developing cyber resilience.

Given these sobering statistics, organizations need to step up their strategies to prevent, detect, and contain fraud to protect themselves from significant financial, organizational, and reputational harm. It is not a question of if, but when fraud strikes an organization—no organization is immune to this risk. With threats coming from both inside and outside the organization, understanding what motivates fraudulent behavior, learning how to identify warning signs, and exposure to effective tools, competencies, and governance strategies are key steps in creating the fraud-resistant organization.

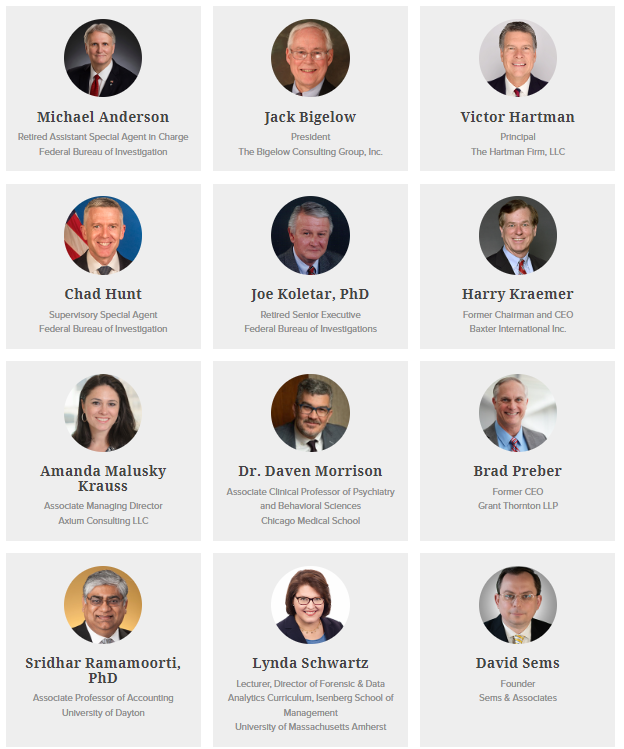

Financial Executives International (FEI), the Behavioral Forensics Group, LLC (B4G), and the University of Dayton Center for Cyber Security & Data Intelligence (UD) have assembled a panel of esteemed industry specialists and anti-fraud professionals to share the latest behavioral insights, strategies, trends, and tools to help business leaders prevent, deter, and mitigate fraud risk.

Why You Should Attend:

- Learn from pivotal players and thought leaders in the anti-fraud space as they deliver actionable insights.

- Understand how to use behavioral psychology to prevent, detect, and contain fraud.

- Earn up to 8 CPE credits.

- Virtual, split-day conference format makes it easier to fit into your busy schedule.

Key Takeaways:

- Understand the fraud threat picture – occupational (asset misappropriation, corruption, financial statements) and cyber.

- Discover what motivates people to commit fraud and how to deter them.

- Find out how to identify warning signs and take a pre-emptive stance against fraud.

- Learn best practices, time-tested and proven implementation strategies in combating fraud.

- Explore the role of those charged with governance in creating a fraud-resistant organization.

SPEAKERS